Amount of taxes taken out of paycheck

To adjust your withholding is a pretty simple process. By placing a 0 on line 5 you are indicating that you want the most amount.

Paycheck Taxes Federal State Local Withholding H R Block

You owe tax at a progressive rate depending on how much you earn.

. Ohio has a progressive income tax system with six tax brackets. The result is the. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

This is the Newest Place to Search. Ad Fast Easy Accurate Payroll Tax Systems With ADP. How You Can Affect Your Texas Paycheck.

Divide the sum of all applicable taxes by the employees gross pay. Determine if state income tax and other state and local taxes and withholdings apply. Multiple jobs or spouse works.

The state tax year is also 12 months but it differs from state to state. For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. This money goes to the IRS where it is counted toward your annual income taxes.

However you can still boost your paycheck through overtime bonuses and commissions. Besides FICA taxes you will see federal income taxes are also taken out of your paychecks. Rates range from 0 to 399.

There are two types of payroll taxes deducted from an employees paycheck. 250 and subtract the refund adjust amount from that. The current rate for Medicare is 145 for the employer and 145 for.

When you file your tax return youd. For instance the first 9525 you earn each year will be taxed at a 10 federal rate. Some states follow the federal tax.

Then look at your last paychecks tax withholding amount eg. 250 minus 200 50. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Enter your personal information. Ad Look For Awesome Results Now. You pay the tax on only the first 147000 of.

Ad Compare Prices Find the Best Rates for Payroll Services. The amount of taxes taken out is decided by the total number of allowance you claim on line five. That result is the tax withholding amount.

Delivering Top Results from Across the Web. Sign Up Today And Join The Team. If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. You need to submit a new W-4 to your employer giving the new amounts to be. How much you pay in federal income taxes depends on several factors including your marital status and if you want additional tax withheld from your paycheck.

So your big Texas paycheck may take a hit when your property taxes come due. An example of how this works. Sign Up Today And Join The Team.

Social Security and Medicare. Learn About Payroll Tax Systems. Make Your Payroll Effortless and Focus on What really Matters.

These are contributions that you make before any taxes are withheld from your paycheck. If you want to boost your paycheck rather than find tax. The first step is filling out your name address and Social Security number.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. If youre willing to get smaller paychecks for the sake of tax advantages you can increase the amount. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their.

Over 900000 Businesses Utilize Our Fast Easy Payroll. How do I withhold less taxes on 2020. In the United States the Social Security tax rate is 62 on.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Learn About Payroll Tax Systems. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Choose Your Paycheck Tools from the Premier Resource for Businesses. Ad Get the Paycheck Tools your competitors are already using - Start Now.

Paycheck Calculator Online For Per Pay Period Create W 4

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Check Your Paycheck News Congressman Daniel Webster

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

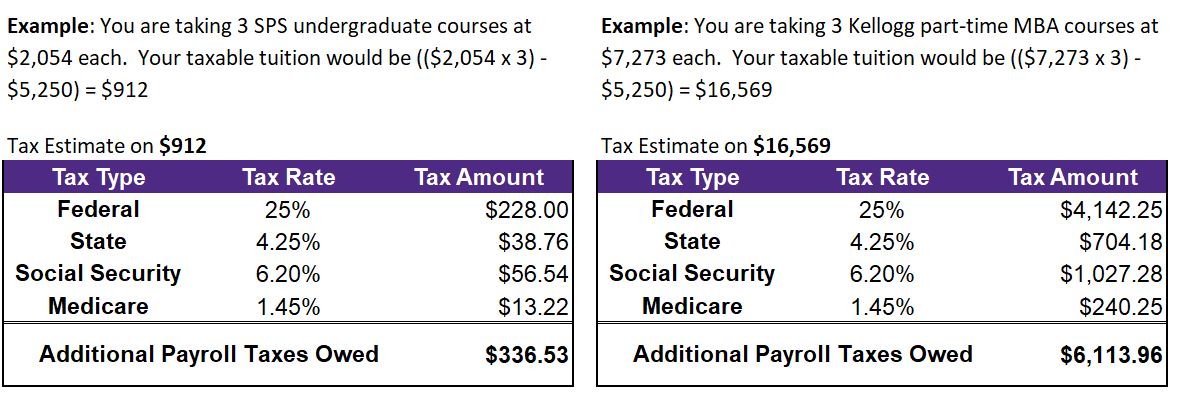

Tuition Taxation Human Resources Northwestern University

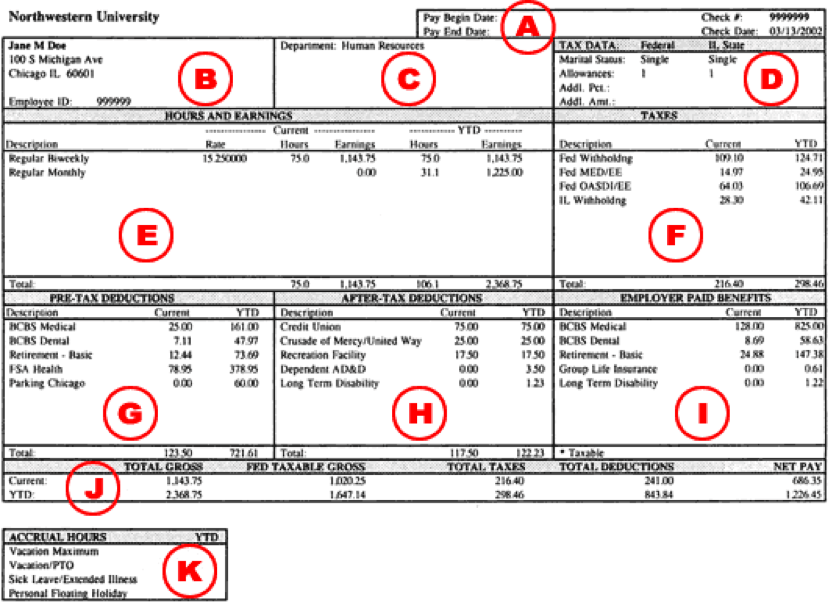

Understanding Your Paycheck

My First Job Or Part Time Work Department Of Taxation

Understanding Your Paycheck Youtube

What Are Payroll Deductions Article

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Irs New Tax Withholding Tables

Tax Information Career Training Usa Interexchange

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck Human Resources Northwestern University